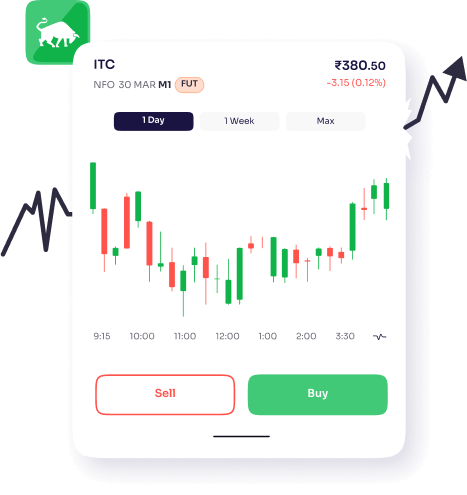

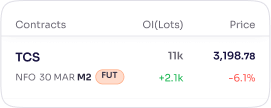

Take intraday or short-term positions across 10000+

contracts based on market volatility

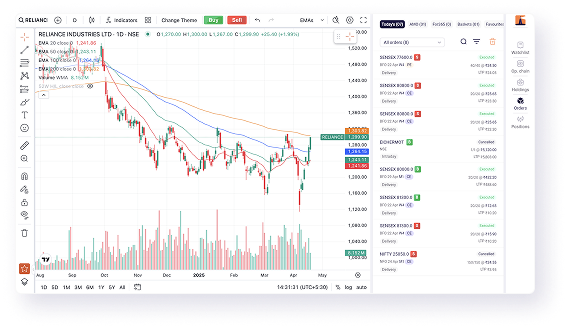

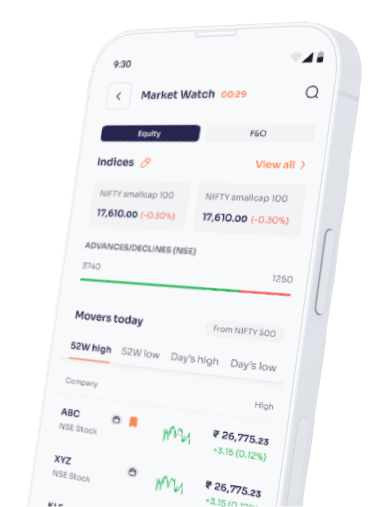

Map price movement & breakouts in all F&O contracts with Charting tools from TradingView

Keep track of up to 8 charts simultaneously

Get a snapshot of your holdings as you analyse technical charts

to get better returns on your trades

Create baskets of multiple orders as per your strategy & execute them in a click

Get additional margins by pledging your holdings to keep trading

Use Bracket & Cover Orders to preset your target & stop-loss prices

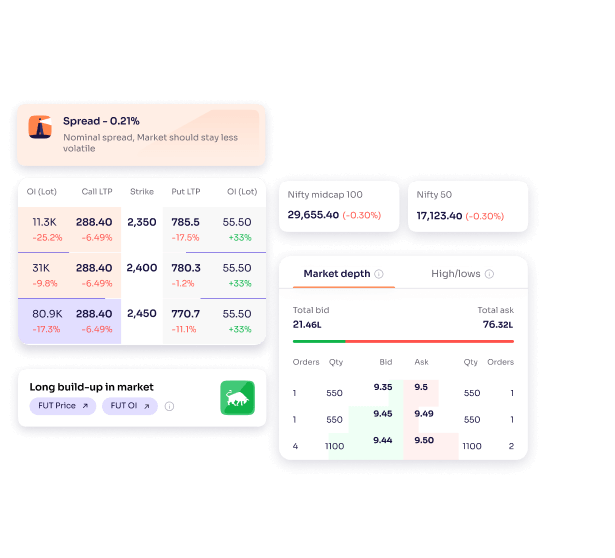

Make informed decisions with live updates on Price OI, Volume data, etc

View the required margin & decide the optimal trading quantity

Square off all your positions in one go

Trading with Ventura has never been easier. Get started in 3 simple steps

Create your account

Open your account in minutes with your Aadhaar & PAN

Fund your wallet

Add money to your wallet in a few clicks via UPI or IMPS/NEFT/RTGS

Start Trading

Analyse & trade the market with our advanced charting tool & live market updates

Options are derivative instruments that are mainly designed to enable investors to hedge their bets on the direction of an asset, such as a stock, currency, commodity, or index over short-terms. An options contact is valid at the most for 3 months.

When trading in options, one generally takes a position (estimates a value) that they expect a stock/index to rise to or fall to within a specific time period. In case this value is achieved one profits from the contract, and in case it is not a loss is incurred. Option contracts are further subdivided into Call & Put options.

Call options give the holder the right to buy the underlying asset and generally reap profit if the strike price rises. While Put options give the holder the right to sell the underlying asset and reap value if the strike price falls.

Futures are a form of derivative instrument that are traded in with the aim of making gains from the movement in a stock, currency or commodity’s value over the short-term. They are defined as an agreement to buy or sell an asset (stock, currency or commodity) at a predetermined price on a future date. These contracts also specify the quantity and quality of the underlying asset, as well as the delivery date and price. When trading in futures one expects the price of an asset to rise or fall to their position taken (expected price) and purchase/sell it.

Using Ventura’s trading platform you can invest across 10,000 Futures & Options contracts and make use of features such as:

Advanced Charting Tool: Using our charting tool you can analyse up to 8 scrips simultaneously and place your orders directly from the chart. Additionally, you can also keep track of your portfolio without switching windows.

Strategy Basket Builder: This tool allows you to select and define the different contracts in your F&O strategy and execute them all in one go.

Bracket & Cover Orders: Bracket & Cover orders allow you to define a Stop-loss and target price for your trades. Helping you minimise losses and sell off the contract in case the Stop-loss value is hit or capitalise on your profits made, in case your desired target is achieved.

Trades in Futures & Options were mainly intended to be a hedging tool to help investors nullify their losses in other assets.

I.e. In case you invested in the stocks of a company and expected it to rise, you could hedge your risks by opting for an F&O contact taking a contrary position. This way even if one of your estimates went wrong the other would help you recover your losses.

However, presently F&O contracts are also used for speculation (buying just an F&O contract expecting the price to rise or fall) and reaping profits in case the expected price is achieved. Being market linked contracts/ instruments, Futures & Options are exposed to the shifts caused in the market prices of their underlying assets. They should be invested in after analysing the general direction of the market & the asset. Among Futures & Options, the latter may be considered as the more secure instrument as they provide more clarity on the possible loss one may incur and also can be invested in for lower amounts.

Futures and Options are complex financial instruments that involve a higher degree of market activity, expertise & risk vis-à-vis other instruments like Stocks or Mutual Funds. It is more suited for active traders in the stock market and those market analysts/traders who have a higher risk appetite.